Image: Intel

The US government is now a major shareholder in Intel Corp. after finalizing a deal to acquire a 10% stake in the company. The arrangement, announced by President Donald Trump on Friday, converts billions in previously promised federal grants into direct equity, marking a highly unusual step for the modern US government.

According to the announcement, the US government did not pay new cash for the shares. Instead, the equity stake is backed by reallocated funding totaling roughly $8.9 billion, drawn from existing grant programs. That includes $5.7 billion from the CHIPS and Science Act signed during the Biden administration and $3.2 billion from a Department of Defense program.

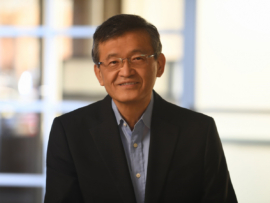

In a post on his Truth Social platform, President Trump celebrated the agreement, stating: “It is my Great Honor to report that the United States of America now fully owns and controls 10% of INTEL, a Great American Company that has an even more incredible future. I negotiated this Deal with Lip-Bu Tan, the Highly Respected Chief Executive Officer of the Company. The United States paid nothing for these Shares, and the Shares are now valued at approximately $11 Billion Dollars.”

He called the deal a win for both the nation and the company, essential for building “leading edge Semiconductors and Chips.”

Turnaround after CEO conflict

The agreement follows a period of tension between the White House and Intel’s leadership. Weeks earlier, President Trump publicly called for CEO Lip-Bu Tan’s resignation over what he described as concerning links to China.

Tan, a US citizen born in Malaysia, defended himself against what he called “misinformation” in a note to staff, asserting he had “always operated within the highest legal and ethical standards.”

Despite the initial dispute, the administration and Intel leadership moved quickly to finalize the agreement following a face-to-face meeting at the White House. The reversal underscores the administration’s intensified focus on boosting domestic chip production.

Commerce Secretary Howard Lutnick praised the outcome on X, saying, “This historic agreement strengthens US leadership in semiconductors, which will both grow our economy and help secure America’s technological edge.” He also thanked Tan for “striking a deal that’s fair to Intel and fair to the American People.”

Potential risks and market reaction

Intel shares initially rose following news of the deal, but the company has cautioned about its potential downsides. In a regulatory filing on Monday, Intel warned shareholders that the government’s stake could lead to “adverse reactions” from international customers, investors, and business partners.

The company highlighted its dependence on overseas markets, with more than 70% of revenue coming from non-US buyers. With the government now a major shareholder, Intel could face heightened scrutiny tied to evolving trade or tariff actions.

The filing also noted that the government’s large shareholding “reduces the voting and other governance rights of stockholders” and may limit future beneficial transactions.

A new corporate strategy

The Intel deal reflects a broader trend of direct government involvement in the tech sector under the Trump administration. Similar moves include agreements with chipmakers Nvidia and AMD, which must pay the government a percentage of sales from AI chips sold in China.

Analysts see this as a new, more direct strategy to advance US economic and national security goals. The government’s stake in Intel is officially passive, meaning it comes with no seat on the company’s board of directors. However, the agreement requires the government to vote its shares inline with Intel’s board on most matters, creating a unique relationship between a public company and its newest, most powerful shareholder.

Learn more in our report on how Trump’s proposed chip tariffs may disrupt global supply chains and reshape the semiconductor industry.